- Table of Contents

- Capital Gains - Asset Appreciation

- Depreciation of Assets

If you hold assets for business purposes, thier decline in value over time can be treated as a deduction for tax purposes, called Depreciation. On the other hand, if you own assets such as real estate, collectibles (like paintings), and investments (like shares in companies), you may see them appreciate in value over time. In this case, you must recognize -- for tax purposes -- what are called Captial Gains

This section discusses the handling of depreciation and appreciation of assets in GnuCash. It also provides a brief introduction to the related tax issues.

Warning: Be aware that different countries can have substantially different tax policies for handling these things; all that this document can really provide is some of the underlying ideas to help you apply your "favorite" tax/depreciation policies.

Appreciation and depreciation of assets are treated somewhat differently:

Depreciation is usually recognized (the technical term is accrued) as an ongoing expense, gradually reducing the value of an asset toward zero. Depreciation is usually only calculated on assets used for professional or business purposes, because governments don't generally allow you to claim depreciation deductions on personal assets, and it's pointless to bother with the procedure if it's not deductible.

Capital Gains, which could be called asset value appreciation, are typically not recognized until the asset is sold, and at that instant, the entire gain becomes income. Governments tend to be quite interested in taxing capital gains in one manner or another. (As always, there are exceptions. If you hold a bond that pays all of its interest at maturity, tax authorities often require that you recognize interest each year, and refuse this to be treated as a capital gain. The phrases accrued interest, or imputed interest are often used to scare those who are sensitive to such things...)

Capital Gains - Asset Appreciation

Appreciation of assets is generally a tricky matter because, for some sorts of assets, it is difficult to correctly estimate an increase in value until you actually sell the asset. If you invest in securities traded daily on open markets such as stock exchanges, prices are often quite exact, and selling the asset at market prices may be as simple as calling a broker and issuing a Market Order. On the other hand, homes in your neighborhood are sold somewhat less often. Such sales tend to involve expending considerable effort, and involve negotiations, which means that estimates are likely to be less precise. Similarly, selling a used automobile involves a negotiation process that makes pricing a bit less predictable.

Values of collectible objects such as jewelry, works of art, baseball cards, and "Beanie Babies" are harder to estimate. The markets for such objects are somewhat less open than the securities markets. Worse still are one-of-a-kind assets. Factories often contain presses and dies customized to build a very specific product that cost tens or hundreds of thousands of dollars; this equipment may be worthless outside of that very specific context. In such cases, several conflicting values might be attached to the asset, none of them unambiguously correct.

Let's suppose you buy an asset expected to increase in value, say a Degas painting, and want to track this. (The insurance company will care about this, even if nobody else does.) Properly tracking the continually increasing value of the Degas will require at least three, quite possibly the following four accounts (plus a bank or cash account where the money for the purchase comes from):

An Asset Cost asset account to track the original cost of the painting.

An Accrued Unrealized Gains on Asset asset account to keep track of increases in value.

An Accrued Gain On Asset Income income account in which to record the income side of the annual gains in your riches.

A Realized Gain On Asset Income income account in which to record the realized income when you sell the asset.

The accrued gains likely won't affect your taxable income for income tax purposes, although it could have some effect on property taxes.

The Handling of Capital Gains in GnuCash

The Acquisition

First, create the asset cost account. To record the purchase, transfer the sum you paid for this painting from your bank account to this asset account.

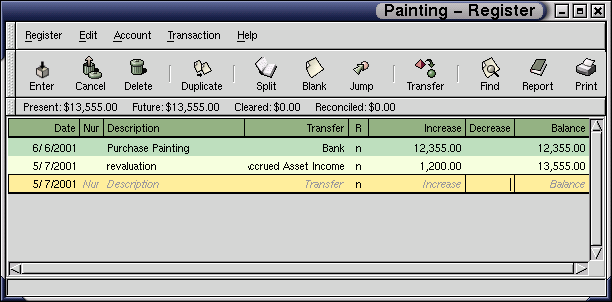

A month later, you have reason to suspect that the value of

your painting has increased by $1200. In order to record this

you transfer $1200 from your accrued gains on asset

income account to your asset account.

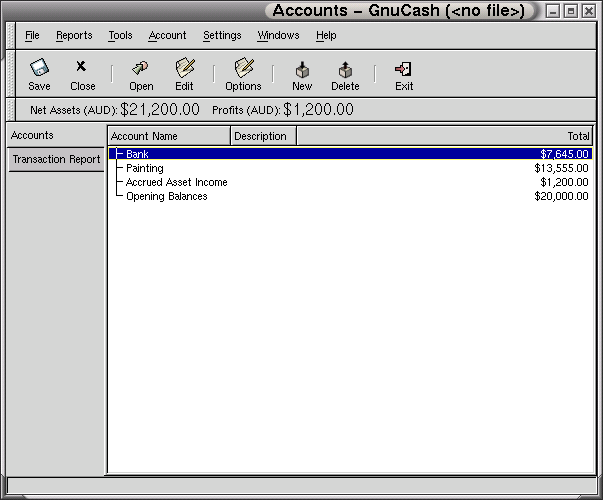

Your main window will resemble this:

and your asset account will resemble this:

While You Hold the Asset

Asset appreciation is a sort of income but it is not cash in hand. The people that got "rich" in 1999 from IPOs of Linux-related companies like Red Hat Software and VA Linux Systems could verify this. They held options or stock that were theoretically valued at millions of dollars USD. They weren't actually millionaires; the principal participants had to hold their stock for at least six months before selling any of it. The fact that they can't sell it means that while it may in theory be worth millions of dollars on paper, there is no way for them to legally get those millions. As history showed, those paper fortunes have gotten considerably smaller.

Selling the Asset

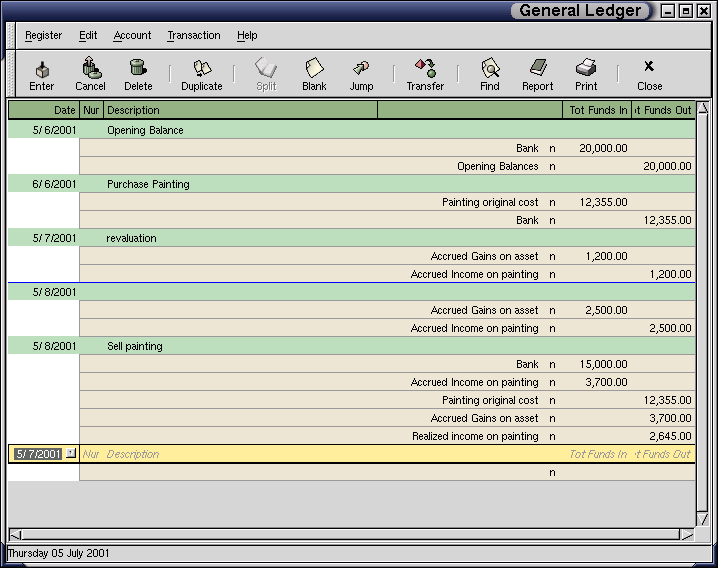

Let's suppose another month later prices for Degas paintings have gone up some more, in your case about $2500, you estimate. You duly record the $2500 as an income like above, then decide to sell the painting.

Three possibilities arise:

Your optimistic estimate of the painting's value was correct. The income account is left alone (or perhaps gets transferred from an Accrued Gain income to a Realized Gain income account), and the recording would appear as follows:

Table 1. Turning an Accrued Gain into a Realized Gain

Account Amount Cash $16055 Painting -$11000 Realized Gain Income -$5055 If any amounts had been accrued as Accrued Gains, the asset amount should be closed out, offset by a negative value for Accrued Gain income. If the total that had been accrued was $5000, then the transaction might look like the following:

Table 2. Accrued Gain becomes Realized Loss

Account Amount Cash $16055 Painting -$11000 Accrued Gain Asset -$5000 Realized Gain Income -$5055 Accrued Gain Income $5000 Note that the two income accounts offset one another so that the current income resulting from the transaction is only $55. The remaining $5000 had previously been recognized as Accrued Gain Income.

You were over-optimistic about the value of the painting. Instead of the $16055 you thought the painting was worth are only offered $15000. But you still decide to sell, because you value $15000 more than you value the painting. The numbers change a little bit, but not too dramatically.

Table 3. Accrued Gain becomes Realized Gain

Account Amount Cash $15000 Painting -$11000 Accrued Gain Asset -$5000 Realized Gain Income -$4000 Accrued Gain Income $5000 Note that the two income accounts offset one another so that the current income resulting from the transaction turns out to be a loss of $1000. That's fine, as you had previously recognized $5000 in income.

You manage to sell your painting for more than you thought in your wildest dreams. The extra value is, again, recorded as a gain, i.e. an income.

In practice, it is very important to keep the Accrued Gain Income separate from the Realized Gain Income, as the former is likely to be ignored by your tax authorities, who will only care to charge you on the Realized Gain.

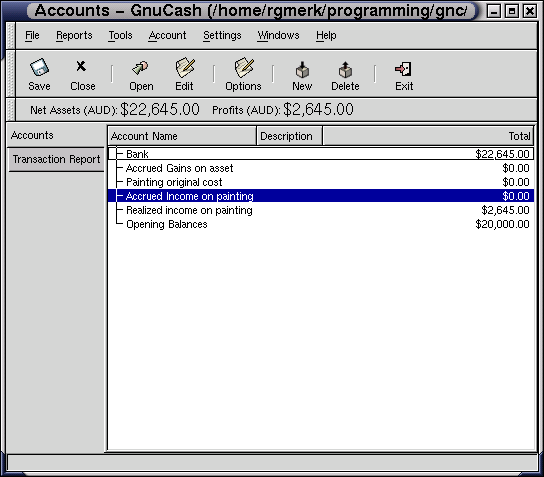

Below, we show the second case discussed.

Caution about Valuation

As we see in this example, for non-financial assets, it may be difficult to correctly estimate the ``true'' value of an asset. It is quite easy to count yourself rich based on questionable estimates that do not reflect "money in the bank."

When dealing with appreciation of assets,

Be careful with your estimation of values. Do not indulge in wishful thinking.

Never, ever, count on money you do not have in your bank or as cash. Until you have actually sold your asset and got the money, any numbers on paper (or magnetic patterns on your hard disk) are merely that. If you could realistically convince a banker to lend you money, using the assets as collateral, that is a pretty reasonable evidence that the assets have value, as lenders are professionally suspicious of dubious overestimations of value. Be aware: all too many companies that appear "profitable" on paper go out of business as a result of running out of cash, precisely because "valuable assets" were not the same thing as cash.

Taxation of Capital Gains

Taxation policies vary considerably between countries, so it is virtually impossible to say anything that will be universally useful. However, it is common for income generated by capital gains to not be subject to taxation until the date that the asset is actually sold, and sometimes not even then. North American home owners usually find that when they sell personal residences, capital gains that occur are exempt from taxation. It appears that other countries treat sale of homes differently, taxing people on such gains. German authorities, for example, tax those gains only if you owned the property for less than ten years.

I have one story from my professional tax preparation days where a family sold a farm, and expected a considerable tax bill that turned out to be virtually nil due to having owned the property before 1971 (wherein lies a critical "Valuation Day" date in Canada) and due to it being a dairy farm, with some really peculiar resulting deductions. The point of this story is that while the presentation here is fairly simple, taxation often gets terribly complicated...