[an error occurred while processing this directive]

You are here: home > programs

and initiatives > tax help > dependents/exemptions

[

skip to navigation for this page ]

Claiming Dependents/Exemptions

- NOTE: For full-time registered students:

- If

your parents are supporting you by paying for > 50% of your expenses

and you are under the age of 24, you cannot claim an exemption even

if your parents do not show you as a dependent on their tax return

- If

your parents are paying < 50%

of your expenses, you can claim exemption for yourself and your parents

cannot consider you as a dependent

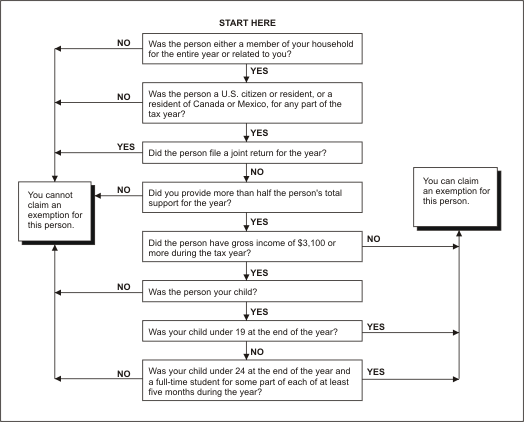

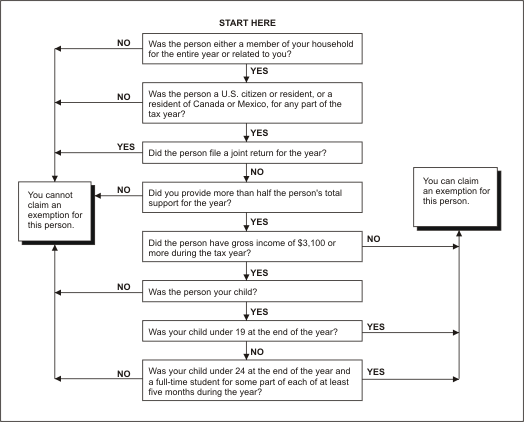

- Please use the flow chart below to determine if YOU can claim another

person as an exemption on your tax form