- Table of Contents

- Using the Financial Calculator

- Explaining Compound Interest

Using the Financial Calculator

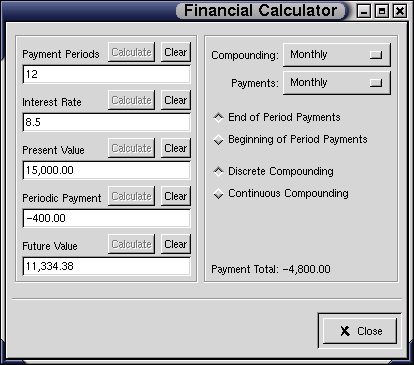

Given that you know the payment interval and compound interval, given any four of Present Value, Future Value, Interest Rate, Periodic Payment, and number of Payment Periods, you can instantly find the missing figure using GnuCash's financial calculator. If you need an explanation of those concepts, see the compound interest tutorial.

To use the financial calculator, find it on the "tools" menu.

To do a calculation, simply enter the figures that you do have into the text boxes on the left, and select the appropriate compounding and payment intervals on the right. Then, to calculate the figure that you want, simply click on the appropriate "calculate" button.

For instance, say you have a loan of $5,000 at %5, compounding monthly, and are paying back $200 at the end of each month. How many payment periods is it going to take to pay back the loan? Easy. Enter "5000" as the present value, the interest rate as "5", the periodic payment as -200 - note that if you are paying money back, this number should be negative, and the future value "0", select the appropriate compounding and payment options (make sure that the "discrete compounding" radio button is selected), and then press "calculate" for the "payment periods" box. You should find that "26" appears in the "Payment Period" box. Therefore, you'll need to make 26 monthly payments to pay back the loan.